Academics

We calibrate every aspect of the Berkeley Haas MFE Program to lead to your career destination.

Your classroom instruction delivers the financial engineering knowledge and best practices you will put to use in the experiential learning that forms the heart of the program. That starts with a 12-week internship and continues with an applied finance project. Both of these experiences put you at the top of the queue when applying for jobs after graduation.

From faculty members who are the force behind groundbreaking financial instruments to the industry leaders who advise on the curriculum, this STEM degree program is designed to be relevant in a constantly evolving industry.

Rigorous Preparation for the Real World

Curriculum

Courses are anchored in cutting-edge research and integrate theories, frameworks, and practical applications in a seamless learning experience.

More about Curriculum

Experiential Learning

You encounter, explore, and address real-world issues and challenges through a 12-week internship and a capstone project.

More on Experiential Learning

Faculty

Professors have influenced, created, and implemented novel financial instruments, strategies, and software—and continue to do so.

More about Our FacultyBerkeley MFE Academics

12

# of months in the program

86

Students entering in 2024

28

Units required to graduate

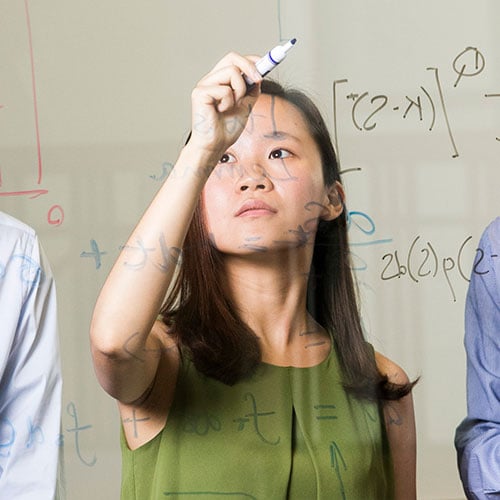

While learning technical skills is important, the more valuable lessons you learn in the Berkeley MFE Program come from exposure to the financial industry. The financial world isn’t pure math; you need to have market sense as well."

Winnie Yu, MFE 18

Quantitative Analyst, PanAgora Asset Management

Boston, Massachusetts

Learn More & Apply

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer sed varius ante. Phasellus sit amet rhoncus mi. In vehicula dapibus lorem fermentum accumsan. Nulla et fermentum enim. Cras sit amet eros leo. Nam nec vehicula odio. Donec molestie congue pulvinar.